Investing made simple

The Simply Investing Report & Analysis Platform

Save time, earn more, and reduce your risk by investing in the best dividend stocks

The SI Platform does the analysis for you; each day it applies the SI approach to over 6000 stocks, and shows you the best stocks to invest in, and which ones to avoid.

The Top Ranked stocks have the lowest risk and the highest potential for long-term gains.

Now you can easily build your own stream of reliable growing passive income by investing in dividend stocks.

Your ultimate tool for finding the best stocks

The SI Platform does the work for you, by automatically applying our quality SI Criteria to over 6000 stocks daily, and then giving each stock an SI Grade out of 10.

The 10 SI Criteria are designed to filter out the best quality stocks that are also priced low. In order to get an SI Grade of 10 out of 10, a stock must pass all these 10 criteria:

- Company must have EPS (earnings per share) growth of 8% or more

- The EPS must have increased at least 8 times in the last 20 years

- Company must have dividend growth of 8% or more

- The payout ratio must be 75% or less

- Company debt must be 70% or less

- Avoid companies with a recent dividend cut

- Company should be actively buying back its own shares

- Price-to-earnings ratio must be 25 or less

- Stock must be priced low (undervalued)

- Price-to-book ratio must be 3 or less

Companies that get an SI Grade of 10 out of 10 have the highest potential for capital appreciation and dividend growth in the long-term.

These companies with the highest SI Grade will provide you with reliable growing passive income from dividends.

Features to help you succeed

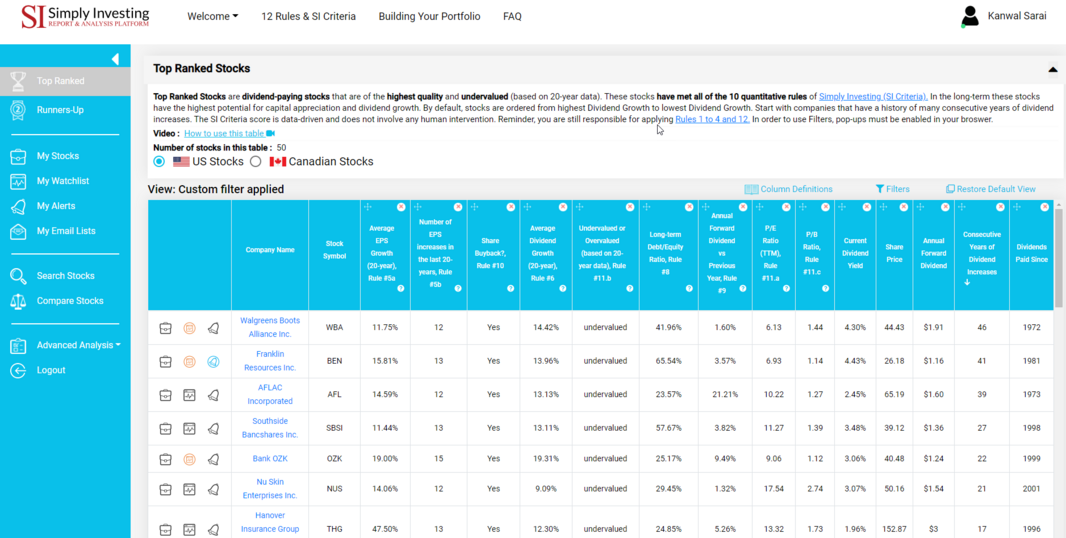

Top Ranked

This page shows you a list of stocks that get an SI Grade of 10 out of 10

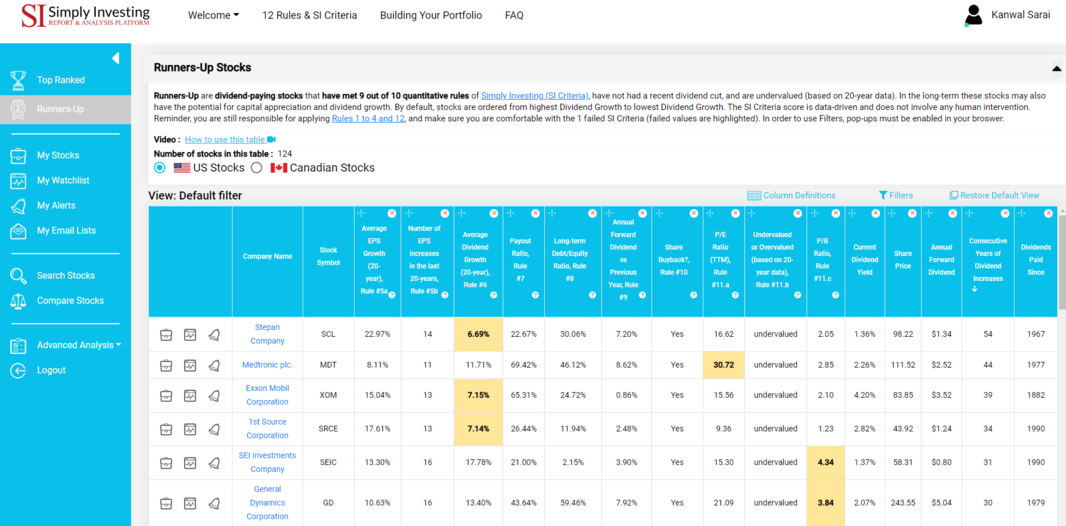

Runners-Up

This page shows you a list of stocks that get an SI Grade of 9 out of 10, failed values are highlighted for you

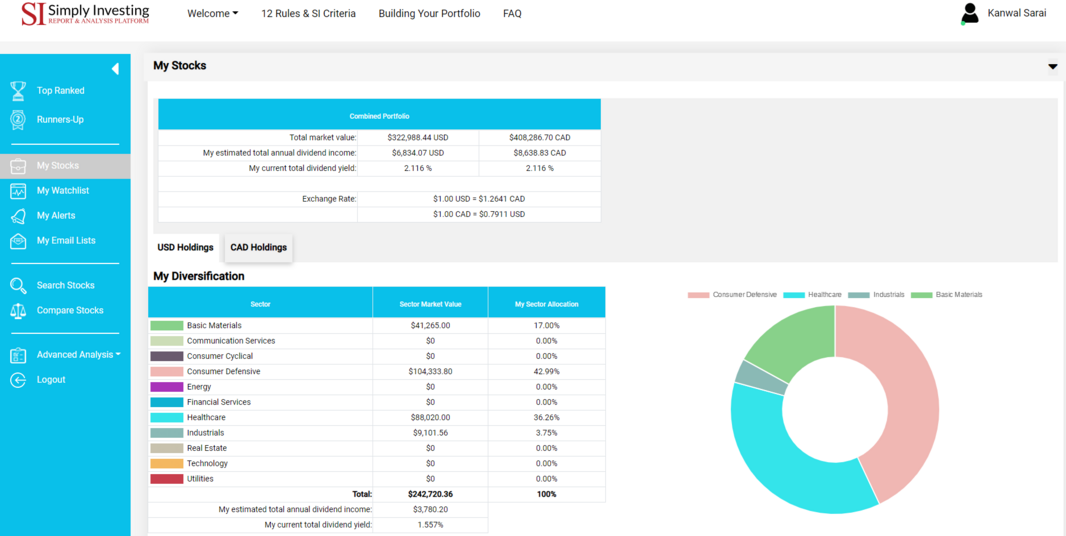

My Stocks

This page allows you to track your own stock portfolio, view your diversification, and view your annual dividend income

My Watchlist

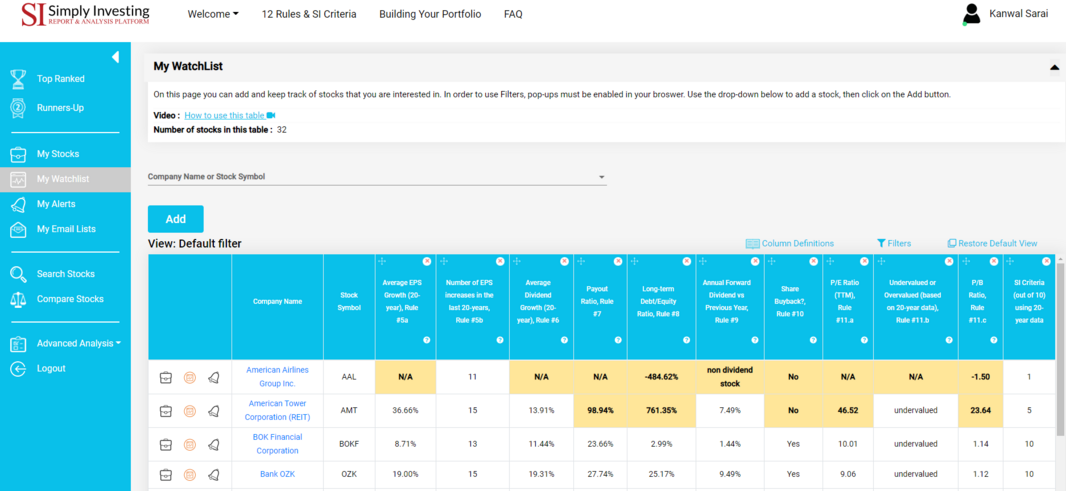

This page allows you to build your own watchlist so that you can track any stock that you are interested in

My Alerts

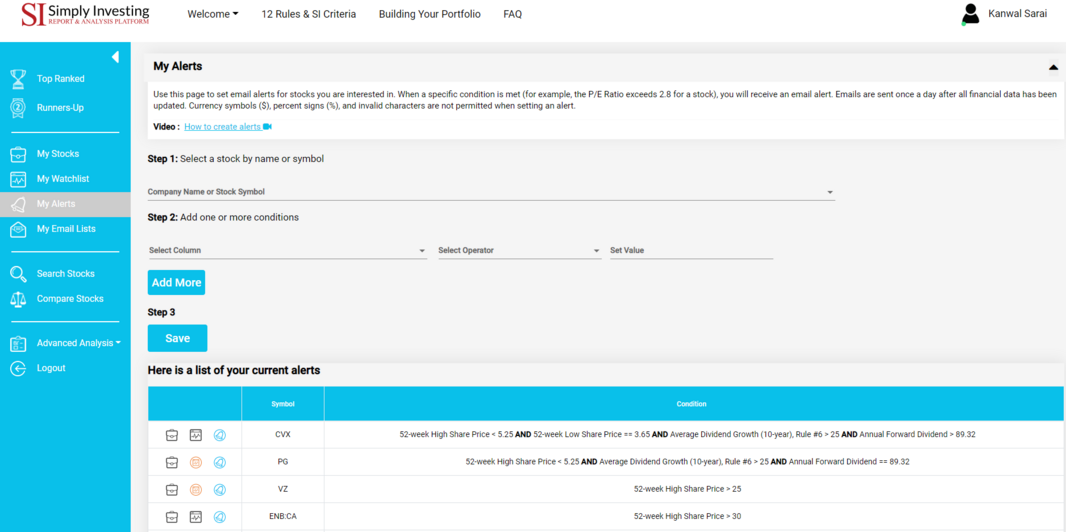

This page allows you to create your own email alerts

My Email Lists

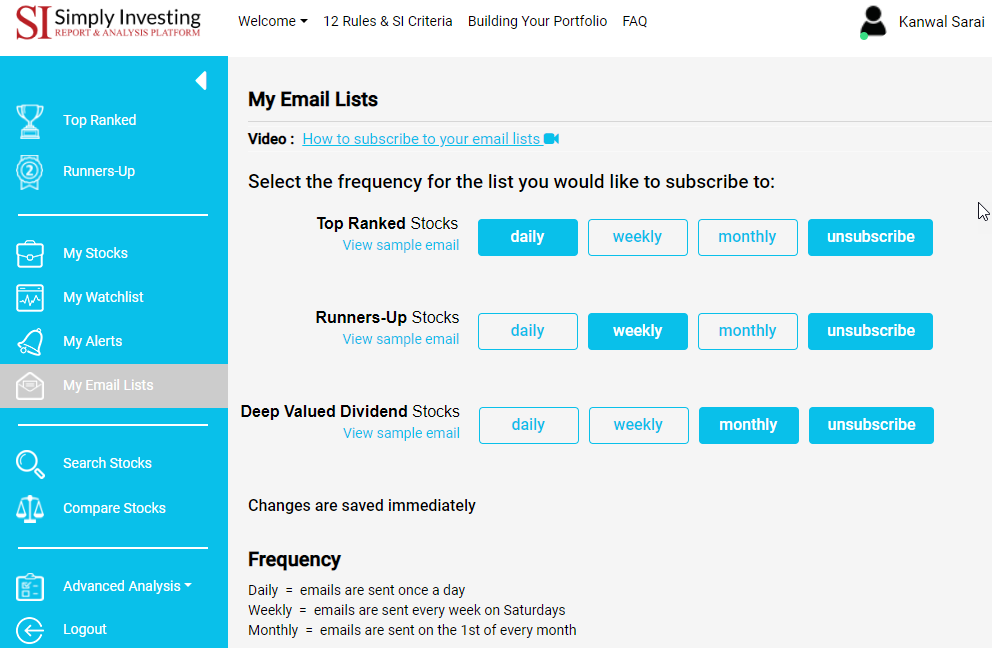

This page allows you to select the frequency and type of stock lists you'd like to receive by email

Search Stocks

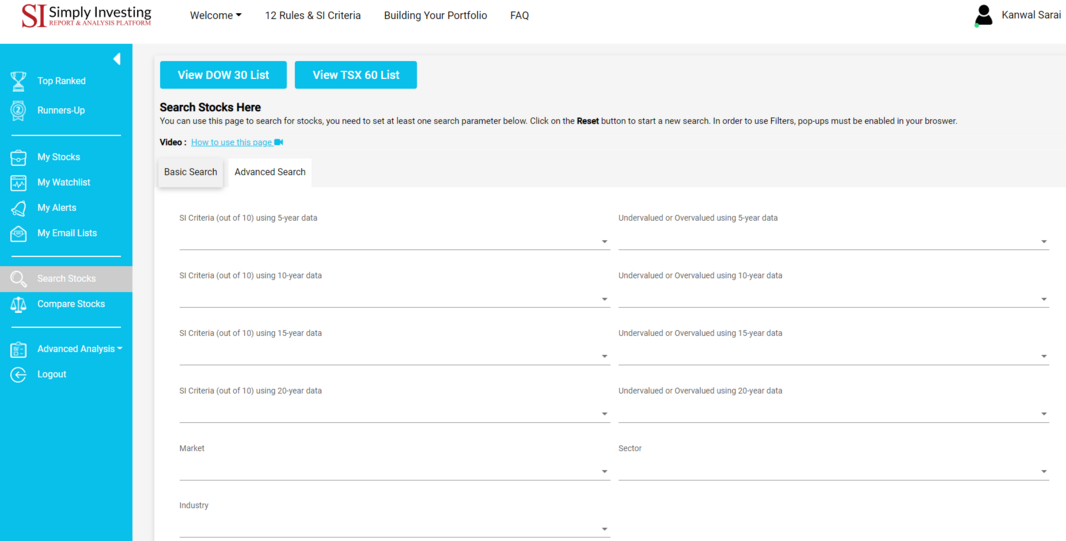

Use this page to search our entire database of over 6000 stocks in the US and Canada

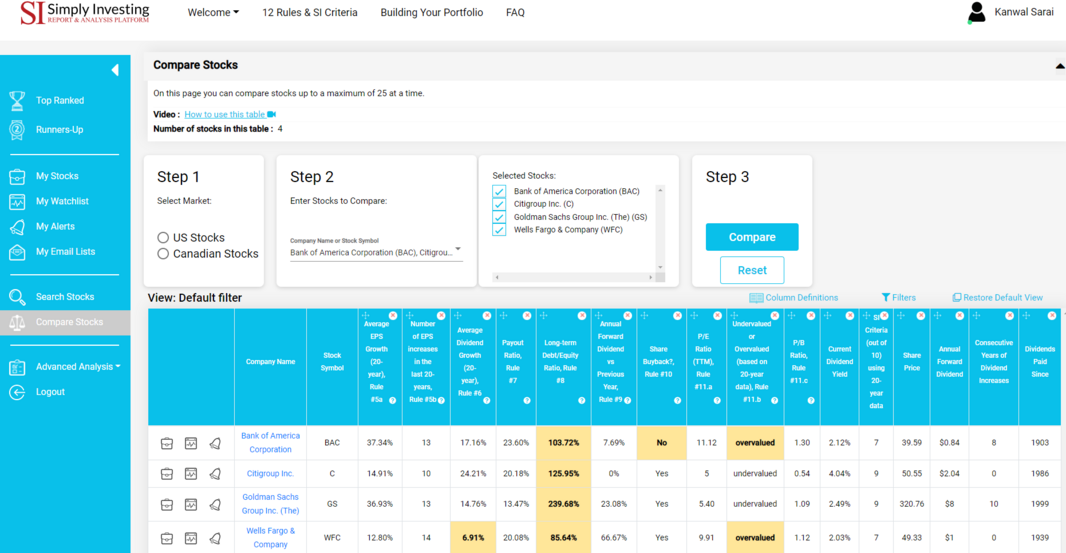

Compare Stocks

Use this page to compare stocks side-by-side

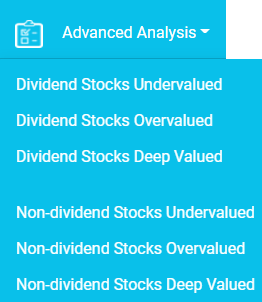

Advanced Analysis

Gives you access to the following 6 pre-built stock tables:

- Dividend Stocks Undervalued, lists all dividend stocks that are undervalued

- Dividend Stocks Overvalued, lists all dividend stocks that are overvalued

- Dividend Stocks Deep Valued, lists all dividend stocks that are deeply undervalued

- Non-Dividend Stocks Undervalued, lists all non-dividend stocks that are undervalued

- Non-Dividend Stocks Overvalued, lists all non-dividend stocks that are overvalued

- Non-Dividend Stocks Deep Valued, lists all non-dividend stocks that are deeply undervalued

“The Simply Investing Platform is so easy to use, it saves me a lot of time! I never knew which stocks to invest in, but now with the Platform I can immediately see the Top Ranked stocks as soon as I login."

Linda Galye

Mother, Technical Writer, Dividend Investor

Right now, you might be thinking:

"Isn't investing risky?"

"Is it going to be time consuming?"

"Won't it be complicated?"

I've heard these questions before, and I've even asked them myself before I started my journey into investing.

More than 20 years of being a dividend investor has taught me that investing:

- isn't complicated

- isn't time consuming

- and isn't risky

...if you have the knowledge of how to invest and what to invest in.

Why re-invent the wheel? Use the SI Platform to help you find the best stocks.

The SI Platform is built for dividend investors by a dividend investor.

Here's what you get:

Top Ranked Stocks are dividend-paying stocks that are of the highest quality and priced low. These stocks have met all of the 10 SI Criteria. In the long-term these stocks have the highest potential for capital appreciation and dividend growth.

Runners-Up are dividend-paying stocks that have met 9 out of 10 quantitative rules of Simply Investing (SI Criteria), have not had a recent dividend cut, and are priced low (undervalued). In the long-term these stocks may also have the potential for capital appreciation and dividend growth.

Any value that fails the SI Criteria is shown in bold and it's cell is highlighted, this makes it easy for you to quickly see any failed values.

On the My Stocks page you can store the list of stocks you currently own, view your portfolio diversification (by sector allocation), and see your estimated annual dividend income. You can also you this page to plan your future portfolio, and forecast your estimated annual dividend income.

US and Canadian stocks are stored in two separate portfolios, however the combined portfolio holdings are displayed at the top of the page (in USD and CAD).

On the My Watchlist page you can add and keep track of stocks that you are interested in. This is a quick way to review any potential candidates for investing in.

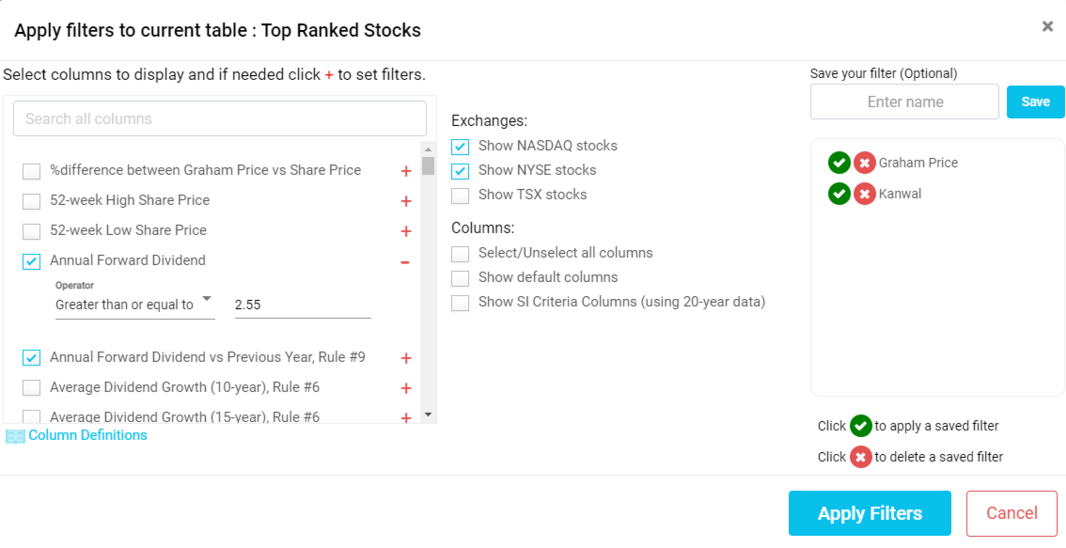

As with any stock tables in the Platform, you can customize your tables: select and order the columns you wish to view, sort and filter the data as you prefer.

On the My Alerts page you can set email alerts for stocks you are interested in. When a specific condition is met (for example, the P/E Ratio exceeds 15 for a stock), you will receive an email alert.

You can also set conditions not available on any other Platform. For example, email me when a specific stock:

- becomes undervalued

- has had 57 years of consecutive dividend increases

- get an SI Grade of 10 out of 10

On the My Email Lists page you can select the frequency and type of stock lists you'd like to receive by email.

Get the list of Top Ranked, Runners-Up, and Deep Valued Dividend stocks emailed directly to your inbox.

On the Search Stocks page you can search for stocks, using the following options:

- Basic Search, search by company name or stock symbol

- Advanced Search, using 11 pre-defined filters

On this page you can also get a list of the Dow 30 list of companies and the TSX 60 list of companies.

On the Compare Stocks page you can compare stock side-by-side.

As with any stock tables in the Platform, you can customize your tables: select and order the columns you wish to view, sort and filter the data as you prefer.

Advanced Analysis gives you access to the following 6 pre-built stock tables:

- Dividend Stocks Undervalued

- Dividend Stocks Overvalued

- Dividend Stocks Deep Valued

- Non-Dividend Stocks Undervalued

- Non-Dividend Stocks Overvalued

- Non-Dividend Stocks Deep Valued

You can customize your stocks tables anywhere on the Platform: select and order the columns you wish to view, sort and filter the data as you prefer.

There are over 120 columns to choose from, you can further filter on the columns, you can also save your filters for later use.

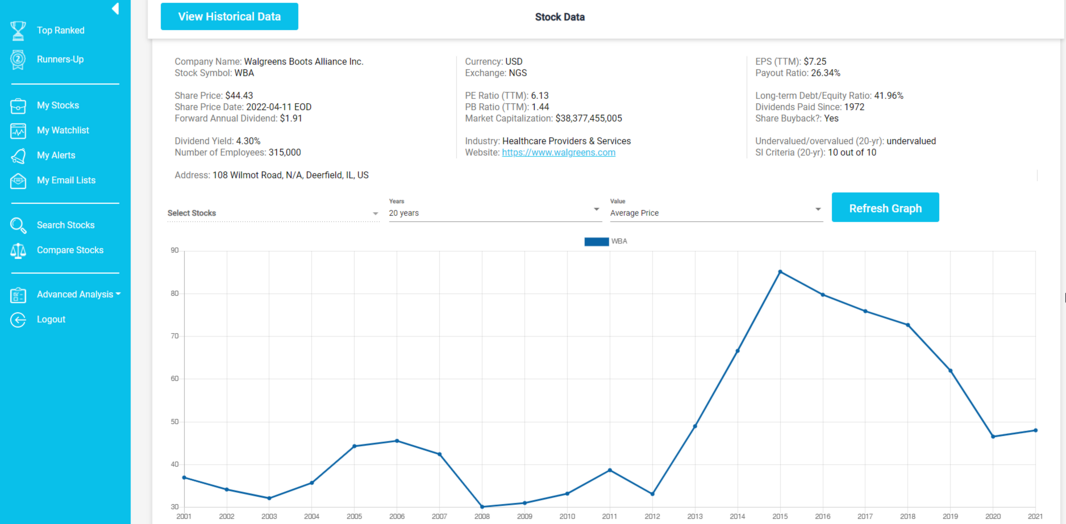

You can view the following 5 types of graphs for any US or Canadian stock:

- Dividends per Share

- Low Price

- High Price

- Average Price

- EPS

With historical data going back 21 years.

Thousands of investors like you use the Simply Investing Platform. Join us today.

Become a successful investor

Finding Quality Stocks

The Platform applies the SI Criteria to over 6000 stocks daily, and assigns an SI Grade. Highest quality stocks get an SI Grade of 10 out of 10

Finding Undervalued Stocks

The Platform shows you daily which stocks are priced low (undervalued) or priced high, including dividend and non-dividend stocks

Building a Resilient Portfolio

Invest in the Top Ranked stocks to build for yourself an income generating portfolio regardless of what happens in the economy

Growing Income

Top Ranked stocks have a history of growing their dividend. Each dividend increase puts more money in your pocket

Investing with Confidence

With the SI Platform you can invest responsibly, minimize your risk, and invest with confidence

Investing with Discipline

With the SI Platform you can remain calm even during market downturns, and continue on your path to financial freedom

See the Simply Investing Platform in action

This video guide shows you how to start investing by using the SI Platform in under 5 minutes

Simply Investing Platform includes:

Access to over:

6000 stocks

Historical data:

over 20 years

Markets covered:

US & Canada

This Simply Investing Platform is a

Must Have if...

- you are tired of wasting your money on fund fees

- you want to grow your net worth

- you want to build a reliable stream of growing passive income, regardless of what happens in the economy

- you want to take charge of your investments

- you want to earn more, save your time, and reduce your risk

Thousands of investors like you use the Simply Investing Platform. Join us today.

What happens after you subscribe?

You'll get an email with instructions to access the Platform, you get instant access to:

- over 6000 stocks (US and Canada)

- Top Ranked stocks, Runners-Up stocks, Deep Valued stocks

- setup your own email alerts

- 18 video tutorials available in the Platform

- comprehensive FAQ page

- guidelines for building your portfolio

- and much more

Do You Have Any Questions?

Do You Have Any Questions?

The key is to buy quality stocks when they are priced low (undervalued).

A quality company (stock) is one which passes all the 10 SI Criteria. Stock prices change all the time, each day our Platform shows you which stocks are priced low, and which ones are quality companies. The Platform also shows you which stocks to avoid. The Platform applies the 10 SI Criteria to over 6000 stocks each day.

In order to make money you need: time in the market and money

Time to take advantage of dividend increases. The younger you start investing the better off you will be. It takes many years for dividend increases to finally start yielding double-digit returns. With enough time on your side you will be able to weather any economic downturns.

You need money to make money. Here's a look at the returns based on how much you invest, for a single stock yielding 5%:

- $1000 invested after one year will yield $50 in dividends

- $10000 invested after one year will yield $500 in dividends

The more money you invest the more money you can make.

Having both time and money will help you achieve financial success sooner.

To answer your question then, how much money can I make? This will depend on how much money you are able to invest, and how long you are able to stay invested.

You can download our Excel Spreadsheet to estimate how much money you can make. You can then update the values in the green cells to try out different scenarios.

Investing in anything carries risk, including mutual funds, index funds, and ETFs.

It's important to focus on investing in quality dividend paying stocks (when they are priced low) to minimize your risk.

Each day the SI Platform analyzes over 6000 companies in North America, and identifies the safest ones to invest for the long-term. You can minimize your risk by investing in profitable companies providing much needed products and services. Further increase your margin of safety by buying these quality companies when they are priced low (undervalued).

Online investing has made it very easy to buy and sell stocks from the comfort of your own home.

Buying and selling stocks is as simple as paying your bills online. Online stock brokerages provide you with all the tools and support you need to help you buy/sell stocks. Our Platform helps you know which stocks to buy and which ones to avoid.

As a stock holder you are part owner of the company.

As part owner of the company you are entitled to share in the profits of the company. An annual dividend (part of the profit) is a cash payment made to stock holders.

Some companies in our Platform have been paying dividends for over 100 years. The other way to make money with stocks is when the stock price increases and you can sell your stocks for a profit.

The Simply Investing Report & Analysis Platform:

1. tracks over 6000 common stocks that trade on the NYSE, NASDAQ, and TSX

2. automatically updates stock prices and financial data once a day (end-of-day)

3. applies the SI Criteria to all stocks once a day

4. over 120 metrics are available for each stock

5. shows you which stocks to consider (Top Ranked) and which ones to avoid (overvalued)

6. updates the following pre-built 8 stock tables daily, and makes them easy to view:

- Top Ranked Stocks, stocks that achieve a 10 out of 10 in the SI Criteria

- Runners-Up Stocks, stocks that achieve a 9 out of 10 in the SI Criteria

- Dividend Stocks Undervalued, lists all dividend stocks that are undervalued

- Dividend Stocks Overvalued, lists all dividend stocks that are overvalued

- Dividend Stocks Deep Valued, lists all dividend stocks that are deeply undervalued

- Non-Dividend Stocks Undervalued, lists all non-dividend stocks that are undervalued

- Non-Dividend Stocks Overvalued, lists all non-dividend stocks that are overvalued

- Non-Dividend Stocks Deep Valued, lists all non-dividend stocks that are deeply undervalued

7. allows you to track your portfolio, view your diversification, and estimate your annual income

8. allows you to build your own stock watch list

9. allows you to create your own email stock alerts

10. allows you to receive daily, weekly, or monthly stock tables in your email inbox

11. includes basic and advanced search capabilities

12. provides a list of the DOW 30 and TSX 60 stocks (updated daily)

13. allows you to generate your stock graphs (dividends per share, low price, high price, average price, EPS)

14. allows you to compare stocks side-by-side

15. shows you immediately which stock fails which of the 10 SI Criteria, the values are in bold, and the cells are highlighted

16. each table shows you the SI Criteria definition

17. provides you with more than 20 years of historical stock data

18. allows you to customize your stock tables: you can add/hide/move columns, you can sort columns, perform advance searches

19. includes guidelines for building your stock portfolio

20. includes 18 video tutorials to demonstrate the features on the Platform

21. includes a comprehensive FAQ section

22. includes this data and more for each stock:

- dividends paid since

- consecutive years of dividend increases

- consecutive years of EPS increases

- 5-year, 10-year, 15-year, 20-year average dividend growth

- 5-year, 10-year, 15-year, 20-year average EPS growth

- Graham Price

- PEG Ratio

- Quick Ratio

- ROA, ROC, ROE

- P/CF, P/FCF, P/S

- undervalued (priced low), or overvalued (priced high) status for both dividend and non-dividend stocks

23. Zero advertising

Below is a complete list of metrics (column headings and their definitions) available to you in the Simply Investing Report & Analysis Platform stock tables:

1. % difference between Graham Price vs Share Price: The percent difference between the Graham Price and the Share Price. This value will not be displayed if the Graham Price is "N/A".

2. 52-week High Share Price: The 52-week high Share Price.

3. 52-week Low Share Price: The 52-week low Share Price.

4. Annual Forward Dividend: The annual forward dividend per share.

5. Annual Forward Dividend vs Previous Year, Rule #9: This is Rule #9 from the 12 Rules of Simply Investing. This value calculates the dividend increase (or decrease) in the Annual Forward Dividend compared to the stock's previous most recent Annual Dividend per share listed in the company's annual report. For example if a stock has an Annual Forward Dividend of $1.64 and it's previous year dividend was $1.60, then the value 2.5% will be displayed. There are three other values that can be displayed in this column:

- "non-dividend stock" will be displayed for stocks that do not pay dividends

- "dividend eliminated" will be displayed for stocks that paid a dividend in the previous year, but no longer pay a dividend

- "new dividend" will be displayed for stocks that did not pay a dividend in the previous, but have now started to pay a dividend

6. Average Dividend Growth (10-year), Rule #6: This is Rule #6 from the 12 Rules of Simply Investing. This value calculates the trimmed mean (average) dividend growth from the last 10 years. A trimmed mean (similar to an adjusted mean) is a method of averaging that removes one largest and one smallest value in the set before calculating the mean.

7. Average Dividend Growth (15-year), Rule #6: This is Rule #6 from the 12 Rules of Simply Investing. This value calculates the trimmed mean (average) dividend growth from the last 15 years. A trimmed mean (similar to an adjusted mean) is a method of averaging that removes one largest and one smallest value in the set before calculating the mean.

8. Average Dividend Growth (20-year), Rule #6: This is Rule #6 from the 12 Rules of Simply Investing. This value calculates the trimmed mean (average) dividend growth from the last 20 years. A trimmed mean (similar to an adjusted mean) is a method of averaging that removes one largest and one smallest value in the set before calculating the mean.

9. Average Dividend Growth (5-year), Rule #6: This is Rule #6 from the 12 Rules of Simply Investing. This value calculates the average dividend growth from the last 5 years.

10. Average Dividend Yield (10-year): The average dividend yield from the last 10 years.

11. Average Dividend Yield (15-year): The average dividend yield from the last 15 years.

12. Average Dividend Yield (20-year): The average dividend yield from the last 20 years.

13. Average Dividend Yield (5-year): The average dividend yield from the last 5 years.

14. Average EPS for the last 3 years: Average EPS calculated from the last 3 years.

15. Average EPS Growth (10-year), Rule #5a: This is Rule #5a from the 12 Rules of Simply Investing. This value calculates the trimmed mean (average) EPS growth from the last 10 years. A trimmed mean (similar to an adjusted mean) is a method of averaging that removes one largest and one smallest value in the set before calculating the mean.

16. Average EPS Growth (15-year), Rule #5a: This is Rule #5a from the 12 Rules of Simply Investing. This value calculates the trimmed mean (average) EPS growth from the last 15 years. A trimmed mean (similar to an adjusted mean) is a method of averaging that removes one largest and one smallest value in the set before calculating the mean.

17. Average EPS Growth (20-year), Rule #5a: This is Rule #5a from the 12 Rules of Simply Investing. This value calculates the trimmed mean (average) EPS growth from the last 20 years. A trimmed mean (similar to an adjusted mean) is a method of averaging that removes one largest and one smallest value in the set before calculating the mean.

18. Average EPS Growth (5-year), Rule #5a: This is Rule #5a from the 12 Rules of Simply Investing. This value calculates the average EPS growth from the last 5 years.

19. Average High Dividend Yield (10-year): The average high dividend yield from the last 10 years.

20. Average High Dividend Yield (15-year): The average high dividend yield from the last 15 years.

21. Average High Dividend Yield (20-year): The average high dividend yield from the last 20 years.

22. Average High Dividend Yield (5-year): The average high dividend yield from the last 5 years.

23. Average High P/E Ratio (10-years): The average high P/E ratio from the last 10 years.

24. Average High P/E Ratio (15-years): The average high P/E ratio from the last 15 years.

25. Average High P/E Ratio (20-years): The average high P/E ratio from the last 20 years.

26. Average High P/E Ratio (5-years): The average high P/E ratio from the last 5 years.

27. Average Low Dividend Yield (10-year): The average low dividend yield from the last 10 years.

28. Average Low Dividend Yield (15-year): The average low dividend yield from the last 15 years.

29. Average Low Dividend Yield (20-year): The average low dividend yield from the last 20 years.

30. Average Low Dividend Yield (5-year): The average low dividend yield from the last 5 years.

31. Average Low P/E Ratio (10-years): The average low P/E ratio from the last 10 years.

32. Average Low P/E Ratio (15-years): The average low P/E ratio from the last 15 years.

33. Average Low P/E Ratio (20-years): The average low P/E ratio from the last 20 years.

34. Average Low P/E Ratio (5-years): The average low P/E ratio from the last 5 years.

35. Average P/E Ratio (10-years): The average P/E ratio from the last 10 years.

36. Average P/E Ratio (15-years): The average P/E ratio from the last 15 years.

37. Average P/E Ratio (20-years): The average P/E ratio from the last 20 years.

38. Average P/E Ratio (5-years): The average P/E ratio from the last 5 years.

39. Book Value per Share: Book value per share is the ratio of a company's common equity divided by its number of outstanding shares.

40. Cash Flow per Share: Cash flow per share is calculated by dividing cash flow earned by the total number of outstanding shares.

41. Company Address, City: This value "City" is part of the company's address (typically it's corporate headquarters).

42. Company Address, Country: This value "Country" is part of the company's address (typically it's corporate headquarters).

43. Company Address, State: This value "State/Province" is part of the company's address (typically it's corporate headquarters).

44. Company Address1: This value "Address1" is part of the company's address (typically it's corporate headquarters), typically the building number and street name.

45. Company Address2: This value "Address2" is part of the company's address (typically it's corporate headquarters), typically the building number and street name.

46. Company Description: A brief description of the company and it's products and services.

47. Company Name: The company's name.

48. Consecutive Years of Dividend Increases: The most recent number of years of consecutive dividend increases.

49. Consecutive Years of EPS Increases: The most recent number of years of consecutive EPS increases.

50. Current Assets: This value is calculated using the following formula, Current Assets = (Current Ratio) x (Current Liabilities)

51. Current Dividend Yield: This value is calculated using the following formula, Current Dividend Yield = (Annual Forward Dividend / Share Price) x 100

52. Current Liabilities (Current Debt): A company's current liability (or debt).

53. Current Ratio: This value is calculated using the following formula, Current Ratio = (Current Assets)/(Current Liabilities)

54. Difference Between Current Dividend Yield and Average Dividend Yield (10-year): The difference between current dividend yield and its 10-year average dividend yield, here is the formula: Difference Between Current Dividend Yield and Average Dividend Yield (10-year) = (((Current Dividend Yield) – (Average Dividend Yield 10-year)) / (Average Dividend Yield 10-year)) * 100

55. Difference Between Current Dividend Yield and Average Dividend Yield (15-year): The difference between current dividend yield and its 15-year average dividend yield, here is the formula: Difference Between Current Dividend Yield and Average Dividend Yield (15-year) = (((Current Dividend Yield) – (Average Dividend Yield 15-year)) / (Average Dividend Yield 15-year)) * 100

56. Difference Between Current Dividend Yield and Average Dividend Yield (20-year): The difference between current dividend yield and its 20-year average dividend yield, here is the formula: Difference Between Current Dividend Yield and Average Dividend Yield (20-year) = (((Current Dividend Yield) – (Average Dividend Yield 20-year)) / (Average Dividend Yield 20-year)) * 100

57. Difference Between Current Dividend Yield and Average Dividend Yield (5-year): The difference between current dividend yield and its 5-year average dividend yield, here is the formula: Difference Between Current Dividend Yield and Average Dividend Yield (5-year) = (((Current Dividend Yield) – (Average Dividend Yield 5-year)) / (Average Dividend Yield 5-year)) * 100

58. Difference Between Current P/E Ratio and Average P/E Ratio (10-year): The difference between current P/E ratio and its 10-year average P/E ratio.

59. Difference Between Current P/E Ratio and Average P/E Ratio (15-year): The difference between current P/E ratio and its 15-year average P/E ratio.

60. Difference Between Current P/E Ratio and Average P/E Ratio (20-year): The difference between current P/E ratio and its 20-year average P/E ratio.

61. Difference Between Current P/E Ratio and Average P/E Ratio (5-year): The difference between current P/E ratio and its 5-year average P/E ratio.

62. Dividend Currency: The currency in which the dividend is paid to shareholders.

63. Dividend Frequency: The frequency of the dividend payment.

64. Dividend Payment Date: This is the date that the stock dividend will be paid.

65. Dividend Record Date: To receive a "cash" dividend you must own the stock on the record date.

66. Dividends Paid Since: The first year in which the company paid a dividend.

67. EPS (TTM): This value is the company's trailing 12-month earnings per share.

68. Exchange: The stock exchange on which a company's stock trades. NYE = NYSE, NSD = NASDAQ, TSX = Toronto Stock Exchange

69. Ex-Dividend Date: This date will always be the first trading day following the "dividend payment date."

70. Fiscal Year-End Date: A company's fiscal year-end date.

71. Graham Price: Graham Price = square root of (average of 3 years of EPS x Book Value per share x 22.5). The Graham price will be "N/A" if any of the following two conditions are true:

- If (Average EPS for the last 3 years) = 0 or negative

- If (Book Value per Share) = 0 or negative

72. High Stock Price (based on 10-year data): For dividend-paying stocks, High Stock Price based on the stock’s 10-year average low dividend yield. For non-dividend paying stocks, High Stock Price based on the stock’s 10-year average high P/E ratio.

73. High Stock Price (based on 15-year data): For dividend-paying stocks, High Stock Price based on the stock’s 15-year average low dividend yield. For non-dividend paying stocks, High Stock Price based on the stock’s 15-year average high P/E ratio.

74. High Stock Price (based on 20-year data): For dividend-paying stocks, High Stock Price based on the stock’s 20-year average low dividend yield. For non-dividend paying stocks, High Stock Price based on the stock’s 20-year average high P/E ratio.

75. High Stock Price (based on 5-year data): For dividend-paying stocks, High Stock Price based on the stock’s 5-year average low dividend yield. For non-dividend paying stocks, High Stock Price based on the stock’s 5-year average high P/E ratio.

76. Industry: The industry the stock belongs to based on the Global Industry Classification Standard.

77. Long-term Debt: A company's long-term debt. Long-term debts, also called long-term liabilities, are debts a company owes third-party creditors that are payable beyond 12 months.

78. Long-term Debt to Total Capital: A Long Term Debt to Capitalization Ratio is the ratio that shows the financial leverage of the firm. This ratio is calculated by dividing the long term debt with the total capital available of a company.

79. Long-term Debt/Equity Ratio, Rule #8: This is Rule #8 from the 12 Rules of Simply Investing. This value calculates the long-term debt to shareholder equity ratio.

80. Low Stock Price (based on 10-year data): For dividend-paying stocks, Low Stock Price based on the stock’s 10-year average high dividend yield. For non-dividend paying stocks, Low Stock Price based on the stock’s 10-year average low P/E ratio.

81. Low Stock Price (based on 15-year data): For dividend-paying stocks, Low Stock Price based on the stock’s 15-year average high dividend yield. For non-dividend paying stocks, Low Stock Price based on the stock’s 15-year average low P/E ratio.

82. Low Stock Price (based on 20-year data): For dividend-paying stocks, Low Stock Price based on the stock’s 20-year average high dividend yield. For non-dividend paying stocks, Low Stock Price based on the stock’s 20-year average low P/E ratio.

83. Low Stock Price (based on 5-year data): For dividend-paying stocks, Low Stock Price based on the stock’s 5-year average high dividend yield. For non-dividend paying stocks, Low Stock Price based on the stock’s 5-year average low P/E ratio.

84. Market (US or Canada): The market that the stock is trading in, Canada = TSX, US = NASDAQ or NYSE.

85. Market Capitalization: Market capitalization, commonly called market cap, is the market value of a publicly traded company's outstanding shares. Market capitalization is equal to the share price multiplied by the number of shares outstanding.

86. My Account Type: This field is used in My Stocks page, the user can leave this field blank, or provide the account type (eg: 401K, IRA, RRSP, RESP, TFSA, Primary account, Spousal account....), basically any text label to help the user differentiate between different trading accounts.

87. Net Income: Net income, also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses. It is a useful number for investors to assess how much revenue exceeds the expenses of an organization. This number appears on a company's income statement and is also an indicator of a company's profitability.

88. Number of Employees: The number of employees employed at the company.

89. Number of EPS increases in the last 10-years, Rule #5b: This is Rule #5b from the 12 Rules of Simply Investing. This value calculates the number of EPS increases in the last 10-years.

90. Number of EPS increases in the last 15-years, Rule #5b: This is Rule #5b from the 12 Rules of Simply Investing. This value calculates the number of EPS increases in the last 15-years.

91. Number of EPS increases in the last 20-years, Rule #5b: This is Rule #5b from the 12 Rules of Simply Investing. This value calculates the number of EPS increases in the last 20-years.

92. Number of EPS increases in the last 5-years, Rule #5b: This is Rule #5b from the 12 Rules of Simply Investing. This value calculates the number of EPS increases in the last 5-years.

93. Number of outstanding shares (Current Year): The current number of outstanding shares in the company.

94. Number of outstanding shares (Previous Year): The number of outstanding shares in the company in the previous year.

95. Operating Cash Flow: Operating cash flow (OCF) is a measure of the amount of cash generated by a company's normal business operations.

96. Operating Cash Flow Ratio: The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a company's operations. This ratio can help gauge a company's liquidity in the short term.

97. P/B Ratio, Rule #11.c: This is Rule #11c from the 12 Rules of Simply Investing. This value calculates the P/B Ratio = (Share Price) / (Book Value per Share)

98. P/CF Ratio: The price to cashflow (P/CF) ratio is a stock valuation indicator or multiple that measures the value of a stock’s price relative to its operating cash flow per share.

99. P/E Ratio (TTM), Rule #11.a: This is Rule #11a from the 12 Rules of Simply Investing. This value calculates the P/E Ratio = (Share Price) / (EPS ttm)

100. P/FCF Ratio: Price to free cashflow is an equity valuation metric used to compare a company's per-share market price to its per-share amount of free cashflow (FCF). This metric is very similar to the valuation metric of price to cash flow but is considered a more exact measure, owing to the fact that it uses free cash flow, which subtracts capital expenditures (CAPEX) from a company's total operating cash flow, thereby reflecting the actual cash flow available to fund non-asset-related growth.

101. P/S Ratio: The price-to-sales (P/S) ratio is a valuation ratio that compares a company’s stock price to its revenues.

102. Payout Ratio, Rule #7: This is Rule #7 from the 12 Rules of Simply Investing. This value calculates the Payout Ratio = ((Annual Forward Dividend) / (EPS ttm)) x 100

103. PEG Ratio (based on Average EPS Growth 10-years): The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for the last 10-years.

104. PEG Ratio (based on Average EPS Growth 15-years): The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for the last 15-years.

105. PEG Ratio (based on Average EPS Growth 20-years): The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for the last 20-years.

106. PEG Ratio (based on Average EPS Growth 5-years): The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for the last 5-years.

107. Profit Margin (Total Operating): Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations, prior to subtracting taxes and interest charges. It is calculated by dividing the operating profit by total revenue and expressing as a percentage. The margin is also known as EBIT (Earnings Before Interest and Tax) Margin.

108. Quick Ratio: The Quick Ratio, also known as the Acid-test or Liquidity ratio, measures the ability of a business to pay its short-term liabilities by having assets that are readily convertible into cash. These assets are, namely, cash, marketable securities, and accounts receivable. These assets are known as “quick” assets since they can quickly be converted into cash.

109. ROA (TTM): Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. This ratio indicates how well a company is performing by comparing the profit (net income) it’s generating to the capital it’s invested in assets.

110. ROC (TTM): Return on capital, or Return on invested capital (ROIC) is a calculation used to assess a company's efficiency at allocating the capital under its control to profitable investments. The return on invested capital ratio gives a sense of how well a company is using its capital to generate profits.

111. ROE (TTM): Return on Equity (ROE) is the measure of a company’s annual return (net income) divided by the value of its total shareholders’ equity.

112. Sector: Sector security belongs to based on the Global Industry Classification Standard.

113. Share Buyback?, Rule #10: This is Rule #10 from the 12 Rules of Simply Investing. This value determined based on the following two parameters:

- if (Number of outstanding shares in the current year) is less than (Number of outstanding shares in the previous year) then "yes"

- if (Number of outstanding shares in the current year) is greater than or equal to (Number of outstanding shares in the previous year) then "no"

114. Share Price (End of Day Price): The share price at the end of business day, business day is referred to as the day when the stock market is open (NASDAQ, NYSE, TSX).

115. Share Price Date: The share price date.

116. SI Criteria (out of 10) using 10-year data: The SI Criteria maximum grade out of 10, based on 10-year data.

117. SI Criteria (out of 10) using 15-year data: The SI Criteria maximum grade out of 10, based on 15-year data.

118. SI Criteria (out of 10) using 20-year data: The SI Criteria maximum grade out of 10, based on 20-year data.

119. SI Criteria (out of 10) using 5-year data: The SI Criteria maximum grade out of 10, based on 5-year data.

120. Stock Symbol: The stock symbol

121. Total Debt to Equity Ratio: The Debt to Equity ratio (also called the “debt-equity ratio”, “risk ratio”, or “D/E”), is a leverage ratio that calculates the weight of total debt and financial liabilities against total shareholders’ equity.

122. Total Stockholder's Equity: Stockholders Equity (also known as Shareholders Equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings. It also represents the residual value of assets minus liabilities. By rearranging the original accounting equation, Assets = Liabilities + Stockholders Equity, it can also be expressed as Stockholders Equity = Assets – Liabilities.

123. Undervalued or Overvalued (based on 10-year data), Rule #11.b: This is Rule #11b from the 12 Rules of Simply Investing. This value is determined based on the following parameters:

- for dividend stocks, if (Current Dividend Yield) is greater than (Average Dividend Yield 10-year) then "undervalued"

- for dividend stocks, if (Current Dividend Yield) is less than or equal to (Average Dividend Yield 10-year) then "overvalued"

- for non-dividend stocks, if (P/E Ratio TTM) is less than (Average P/E Ratio 10-years) then “undervalued”

- for non-dividend stocks, if (P/E Ratio TTM) is greater than or equal to (Average P/E Ratio 10-years) then “overvalued”

124. Undervalued or Overvalued (based on 15-year data), Rule #11.b: This is Rule #11b from the 12 Rules of Simply Investing. This value is determined based on the following parameters:

- for dividend stocks, if (Current Dividend Yield) is greater than (Average Dividend Yield 15-year) then "undervalued"

- for dividend stocks, if (Current Dividend Yield) is less than or equal to (Average Dividend Yield 15-year) then "overvalued"

- for non-dividend stocks, if (P/E Ratio TTM) is less than (Average P/E Ratio 15-years) then “undervalued”

- for non-dividend stocks, if (P/E Ratio TTM) is greater than or equal to (Average P/E Ratio 15-years) then “overvalued”

125. Undervalued or Overvalued (based on 20-year data), Rule #11.b: This is Rule #11b from the 12 Rules of Simply Investing. This value is determined based on the following parameters:

- for dividend stocks, if (Current Dividend Yield) is greater than (Average Dividend Yield 20-year) then "undervalued"

- for dividend stocks, if (Current Dividend Yield) is less than or equal to (Average Dividend Yield 20-year) then "overvalued"

- for non-dividend stocks, if (P/E Ratio TTM) is less than (Average P/E Ratio 20-years) then “undervalued”

- for non-dividend stocks, if (P/E Ratio TTM) is greater than or equal to (Average P/E Ratio 20-years) then “overvalued”

126. Undervalued or Overvalued (based on 5-year data), Rule #11.b: This is Rule #11b from the 12 Rules of Simply Investing. This value is determined based on the following parameters:

- for dividend stocks, if (Current Dividend Yield) is greater than (Average Dividend Yield 5-year) then "undervalued"

- for dividend stocks, if (Current Dividend Yield) is less than or equal to (Average Dividend Yield 5-year) then "overvalued"

- for non-dividend stocks, if (P/E Ratio TTM) is less than (Average P/E Ratio 5-years) then “undervalued”

- for non-dividend stocks, if (P/E Ratio TTM) is greater than or equal to (Average P/E Ratio 5-years) then “overvalued”

127. Website: The link (URL) to the company's corporate website.

The Simply Investing Report & Analysis Platform feature list:

1. tracks over 6000 common stocks that trade on the NYSE, NASDAQ, and TSX

2. automatically updates stock prices and financial data once a day (end-of-day)

3. applies the SI Criteria to all stocks once a day

4. over 120 metrics are available for each stock

5. shows you which stocks to consider (Top Ranked) and which ones to avoid (overvalued)

6. updates the following pre-built 8 stock tables daily, and makes them easy to view:

- Top Ranked Stocks, stocks that achieve a 10 out of 10 in the SI Criteria

- Runners-Up Stocks, stocks that achieve a 9 out of 10 in the SI Criteria

- Dividend Stocks Undervalued, lists all dividend stocks that are undervalued

- Dividend Stocks Overvalued, lists all dividend stocks that are overvalued

- Dividend Stocks Deep Valued, lists all dividend stocks that are deeply undervalued

- Non-Dividend Stocks Undervalued, lists all non-dividend stocks that are undervalued

- Non-Dividend Stocks Overvalued, lists all non-dividend stocks that are overvalued

- Non-Dividend Stocks Deep Valued, lists all non-dividend stocks that are deeply undervalued

7. allows you to track your portfolio, view your diversification, and estimate your annual income

8. allows you to build your own stock watch list

9. allows you to create your own email stock alerts

10. allows you to receive daily, weekly, or monthly stock tables in your email inbox

11. includes basic and advanced search capabilities

12. provides a list of the DOW 30 and TSX 60 stocks (updated daily)

13. allows you to generate your stock graphs (dividends per share, low price, high price, average price, EPS)

14. allows you to compare stocks side-by-side

15. shows you immediately which stock fails which of the 10 SI Criteria, the values are in bold, and the cells are highlighted

16. each table shows you the SI Criteria definition

17. provides you with more than 20 years of historical stock data

18. allows you to customize your stock tables: you can add/hide/move columns, you can sort columns, perform advance searches

19. includes guidelines for building your stock portfolio

20. includes 18 video tutorials to demonstrate the features on the Platform

21. includes a comprehensive FAQ section

22. includes this data and more for each stock:

- dividends paid since

- consecutive years of dividend increases

- consecutive years of EPS increases

- 5-year, 10-year, 15-year, 20-year average dividend growth

- 5-year, 10-year, 15-year, 20-year average EPS growth

- Graham Price

- PEG Ratio

- Quick Ratio

- ROA, ROC, ROE

- P/CF, P/FCF, P/S

- undervalued (priced low), or overvalued (priced high) status for both dividend and non-dividend stocks

23. zero advertising

No, you do not need to buy the Simply Investing Course in order to subscribe to the SI Platform. The SI Platform subscription can be purchased independently.

The Simply Investing Course:

- Consists of 27 video lessons, bonus videos, a guide book (PDF), portfolio tracker, and Google spreadsheet

- The Google Spreadsheet automatically applies the 10 SI Criteria rules to each stock, after you've filled in the financial data

- Teaches you "The 12 Rules of Simply Investing" and how to find quality dividend paying stocks that are undervalued (priced low)

- Can be purchased for a one-time payment, and comes with unlimited access to the course, the SI Platform-Lite, and any future updates

- Value packages also come with membership to the Simply Investing Forum

The Simply Investing Platform-Full:

- The SI Platform is a web application that tracks over 6000 common stocks in the US and Canada

- The SI Platform lists stocks that are undervalued (priced low) and the ones that are overvalued (priced high)

- Applies the SI Criteria to each stock every day, and applies a grade out of 10 to each stock

- Access to all features including the 3 basic features in the SI Platform-Lite

- Provides you with over 120 metrics for each stock

- Can be purchased by a monthly or annual subscription

The Simply Investing Platform-Lite:

- As part of your course purchase, you have access to the following 3 features:

- Basic Search, which gives you access to financial data only on over 6000 common stocks in the US and Canada (including up to 21 years of historical data)

- Access to the DOW 30 list of companies

- Access to the TSX 60 list of companies

- SI Platform-Lite does not apply the SI Criteria, you need to do this yourself by inputting the financial data into the Google Spreadsheet (that comes with the SI Course)

- Access to the SI Platform-Lite cannot be purchased separately, it only comes with the SI Course purchase

In conclusion, the Platform-Lite does not do the research for you, it only provides the financial data for you to perform the analysis yourself. However, the Platform-Full does the work for you, it performs the analysis and gives you the result for over 6000 stocks daily.

SI Platform Monthly Subscription: there are no refunds. You can cancel at anytime.

SI Platform Annual Subscription: there are no refunds. Subscriptions can be cancelled after 12 month commitment. If you are ensure to commit for 12 months, test drive the Platform (using 14-day free trial), or try the monthly subscription first.

WITH THE SIMPLY INVESTING PLATFORM YOU CAN:

Earn more

Reduce your risk

Save your time

Invest in quality stocks

Quickly start earning passive income today

The SI Platform is for you if you're tired of losing money and wasting time

If you’d like to obtain financial freedom sooner than later, sign up for the Simply Investing Platform today.

One of our clients Tracy saved more than $1.3 million dollars in mutual fund fees alone, and grew her passive income by 74% (in a single year) after implementing our Simply Investing approach.

TESTIMONIALS

TESTIMONIALS

What they thought about the platform

What they thought about the platform

Creator of the SI Platform

As a dividend value investor for more than 22 years, I've seen the stock market go up and down. Without knowledge the stock market can seem like a scary place, but it doesn't have to be this way.

The industry tends to confuse people into thinking that investing is complicated. This way the industry can "take" your money and invest it for you, but remember for this "service" they will take from you thousands of dollars in fees over your lifetime.

Now is the best time to take charge of your investments, save on the fees, and build your own stream of growing passive income each year.

The Simply Investing Course makes it easy for you to learn how to invest. The Simply Investing Platform implements our strategy and allows you to easily select quality dividend stocks for long-term growth.

Choose Your Subscription

14-day Free Trial

- Credit card not required

- Limited to sample database of 35 stocks

- No access to My Alerts, My Watchlist

- No access to My Stocks, Email Lists

Single Country

- US NASDAQ, NYSE, or Canadian TSX stocks

- Choose US or Canadian markets

- Access to all features

- Over 120 metrics for each stock

Both Countries

- US NASDAQ, NYSE, and Canadian TSX stocks

- Access to all US and Canadian common stocks

- Access to all features

- Over 120 metrics for each stock

![]()

Disclaimer: Kanwal Sarai is not an investment advisor, certified financial planner, or broker. Kanwal Sarai is an educator and dividend value investor, and has been for more than two decades. The information provided here is for educational purposes. My opinions are based upon information that I consider reliable, but I do not warrant its completeness or accuracy, and it should not be relied upon as such. The statements and opinions on this newsletter/course/report/video/website/presentation are subject to change without notice. I may personally hold securities mentioned in this course/website/report/video/newsletter. The final decision to buy or sell any stock is yours; please do your own due diligence. Stock buy or sell decisions are based on many factors including your own risk tolerance. When in doubt please consult a professional advisor. No advice on the buying and selling of specific securities is provided. Past performance is not a guarantee of future results. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. The names of actual companies or products mentioned herein may be the trademarks of their respective owners. View the complete Terms of Use.